The programme provides the personal finance software company with access to Mastercard’s technology, data connectivity, analytics solutions and its ecosystem of banks, merchants, partners and digital players.

PocketSmith co-founder and chief executive Jason Leong described the announcement as the “birth of a relationship” with Mastercard, one of the biggest payment processors in the world.

Since it was established 16 years ago this month, PocketSmith had been a global company and Mastercard was interested in the business because of its global footprint, he said.

Mastercard was looking at open data, like personal finance, open banking and digital identities and, in five to 10 years, that would probably be very common place in how money was used, Mr Leong said.

“Consumers deserve friction-less access to their financial data, which is essential for making informed and effective decisions. The increasing complexity of our personal finances should be matched with increased transparency and control.

“Open banking has the potential to make this a reality, but its successful implementation relies on collaboration in the fintech space,” he said.

PocketSmith, which has 25 staff, now had customers in 190 countries and offered connectivity to nearly every bank worldwide. When Covid-19 hit, it was already a remote company.

Its growth stalled during the pandemic as personal finance “fell to the bottom of people’s lists of priorities”. But the business had been built to be resilient and they often commented that they ran the business much like running a household; they were self-funding and invested carefully.

There was “so much more” to be done in the next 16 years. When PocketSmith was founded, the iPhone had just been launched which reiterated how different the world was back then, Mr Leong said.

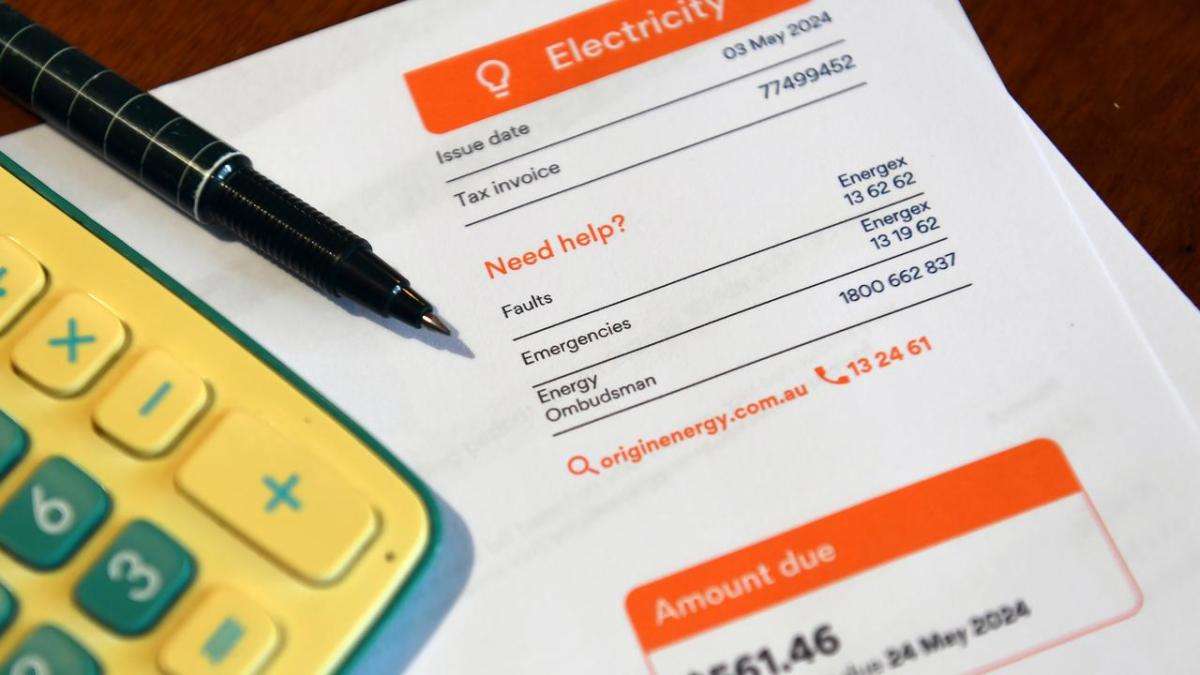

Initially, PocketSmith’s primary market was the United States where there was more awareness of managing money online. Now the biggest market was in Australia, while the business was still growing naturally in the US. It had been nice to see a gradual increase of customers in New Zealand.

What he had learned about working in a business was that it was about being there for the long term and every relationship took work. It was also about being surrounded by a “wonderful team”, Mr Leong said.

“We’ve had a lot of emphasis on culture and having fun … and taking care of each other, particularly as a remote team,” he said.

There were both pros and cons of working out of Dunedin. The city offered an incredible quality of life, although serving consumers in 190 countries meant it was hard to fully get to know them “if you’re not walking a mile in their shoes”.